Get Your Copilot

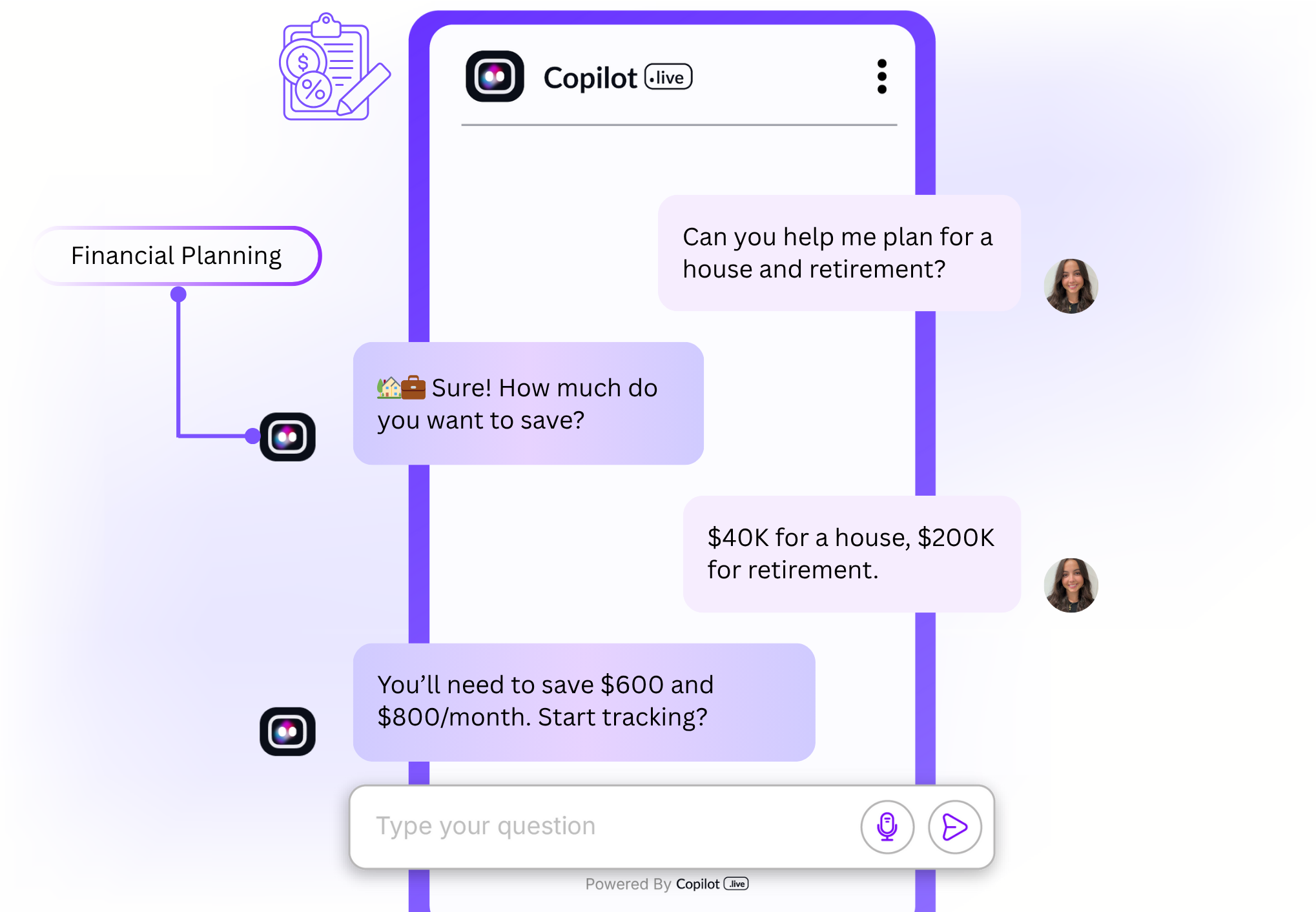

Create an AI Chatbot for Personal Finance (AI Agent)

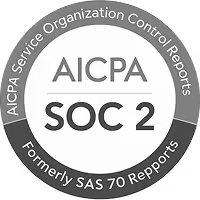

Copilot.live chatbot that makes your finances manageable. Log income, track spending, set goals, and review progress, all through one simple chat interface.

Create an AI Chatbot for Personal Finance (AI Agent)

Copilot.live chatbot that makes your finances manageable. Log income, track spending, set goals, and review progress, all through one simple chat interface.

Build an AI assistant in 3 minutes

How to create a chatbot for personal finance?

Sign Up for Free

Visit Copilot.live and then click on the “Sign Up” button. Type your full name, email address, and password to sign up. You can also sign up immediately with your Google or Apple ID.

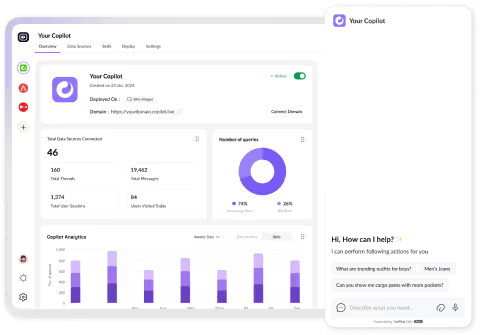

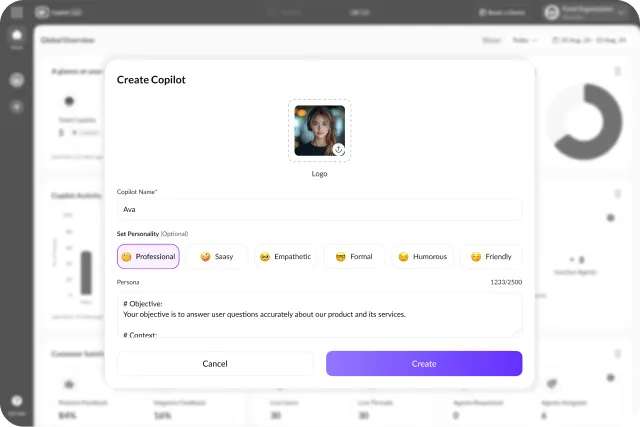

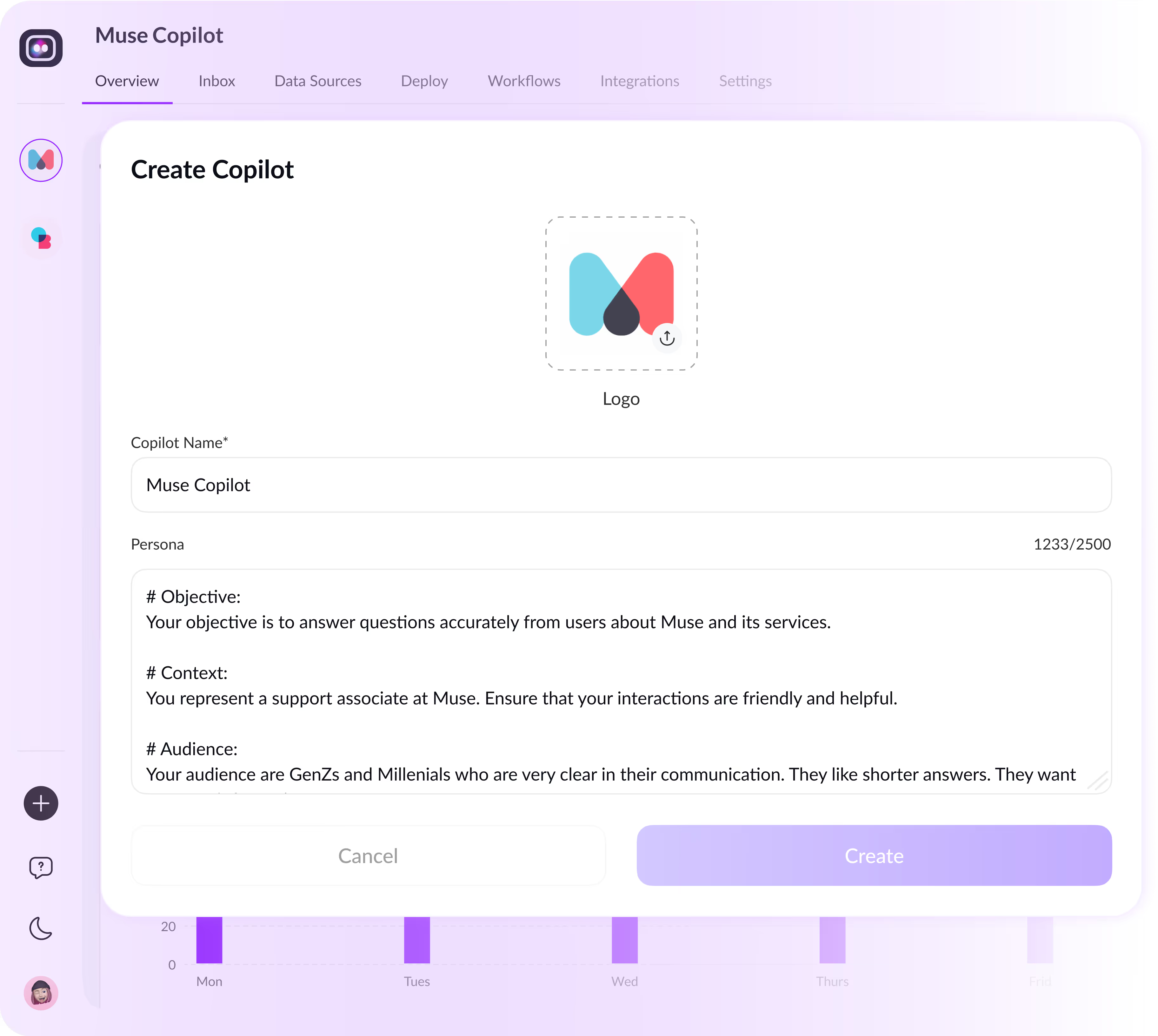

Customize Your Chatbot

Design the look and personality of your chatbot after you create an account. Give it a name, tone, color, and style that best reflects your brand—friendly, clear, and helpful—and you’re good to go.

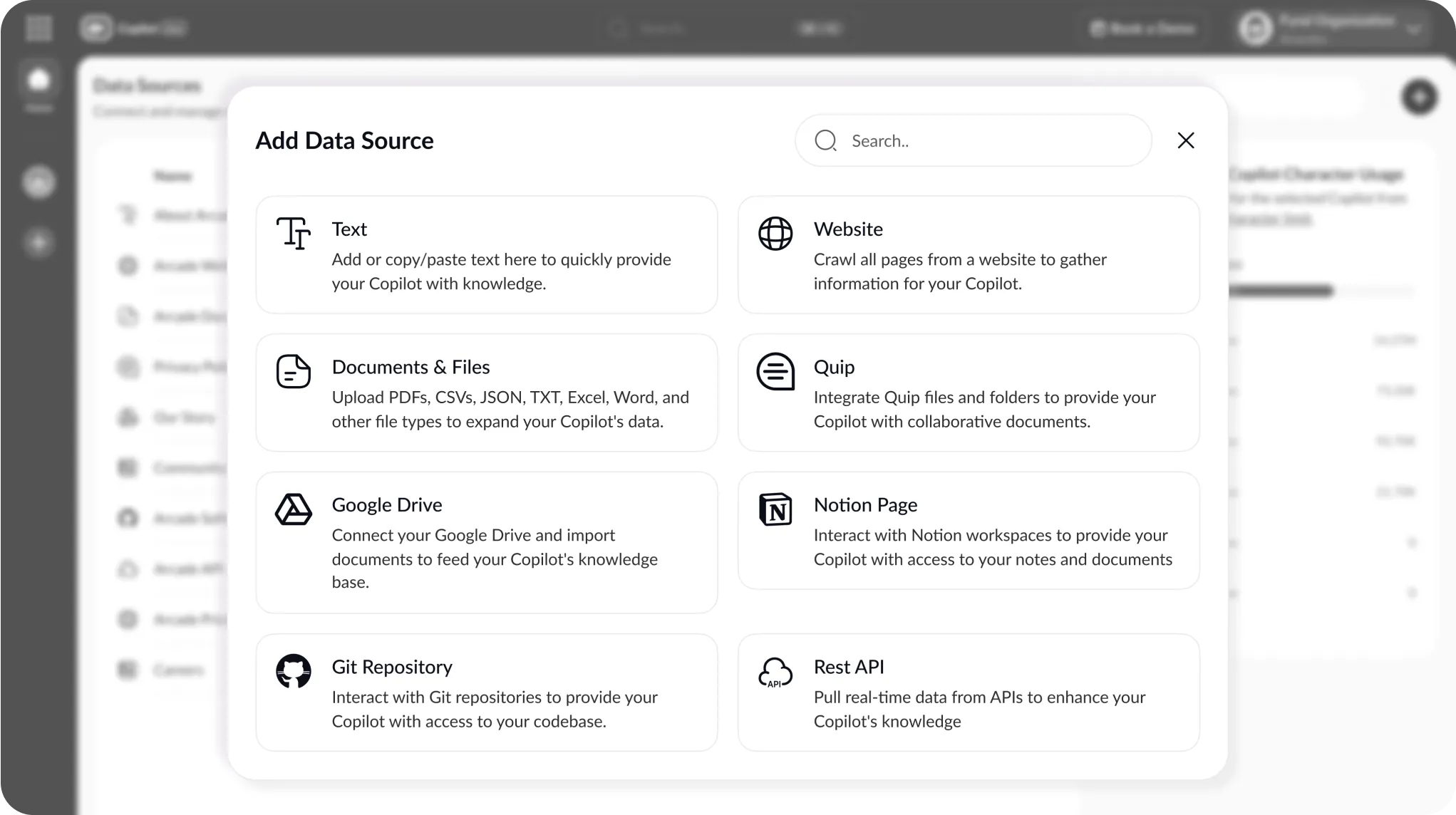

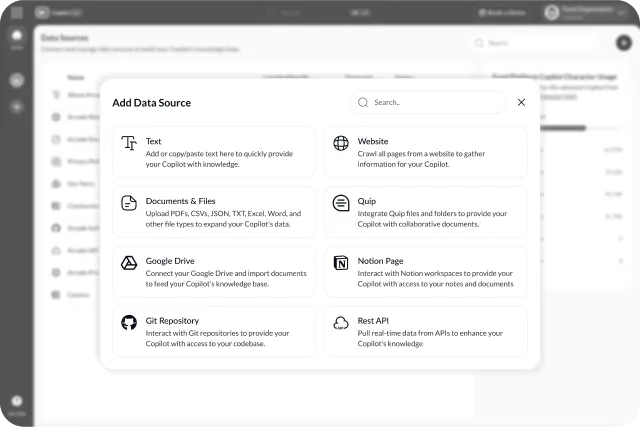

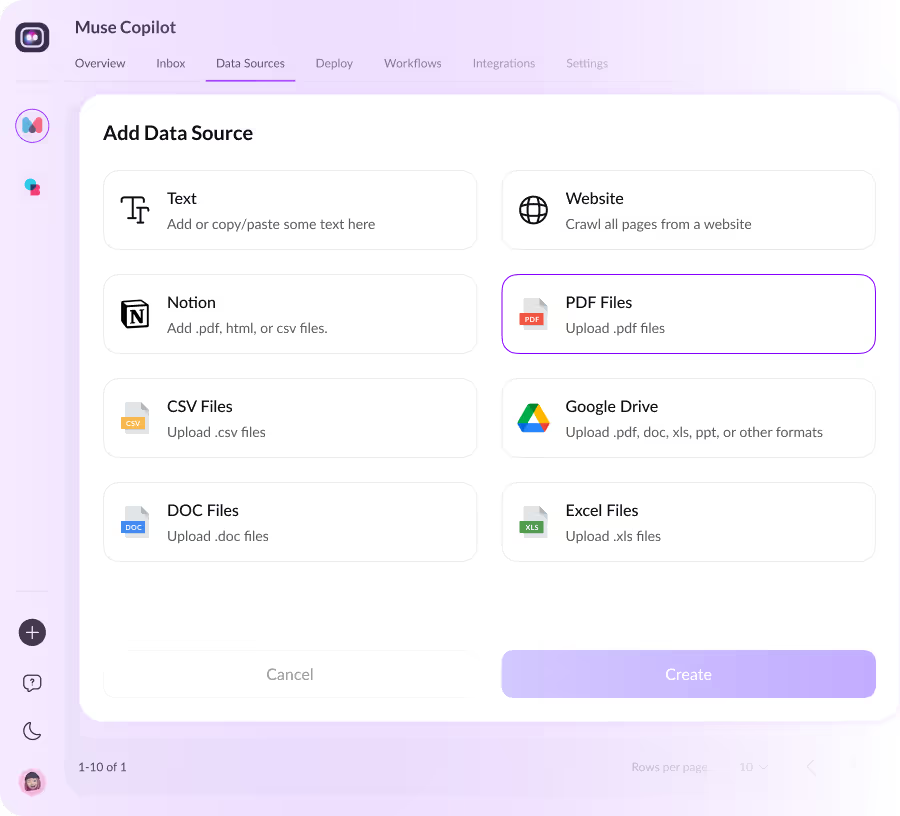

Add Your Data Sources

To teach your chatbot, click on “Add Data Sources.” Upload files, connect databases, link web pages, or add a knowledge base to provide the knowledge to your chatbot.

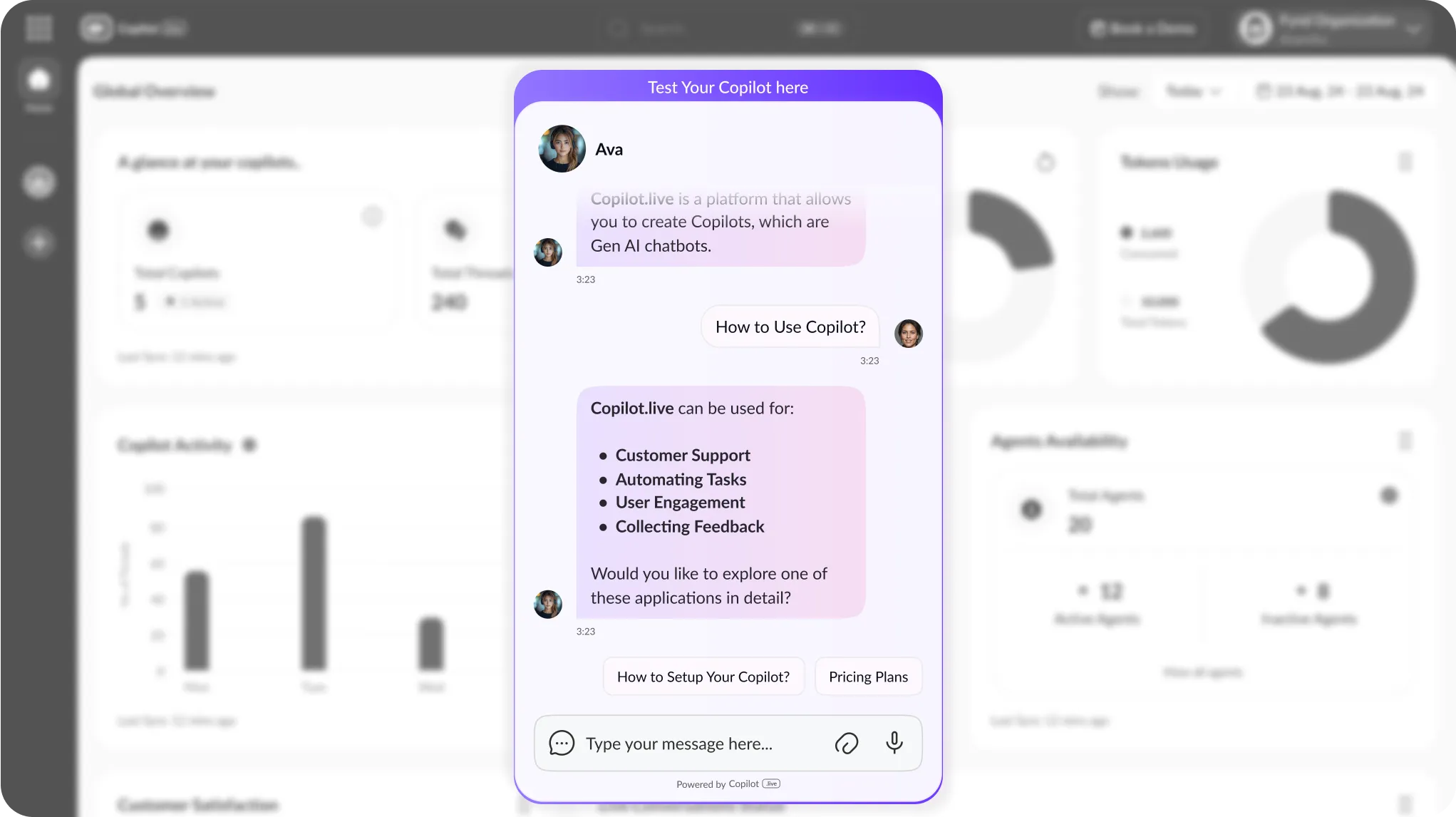

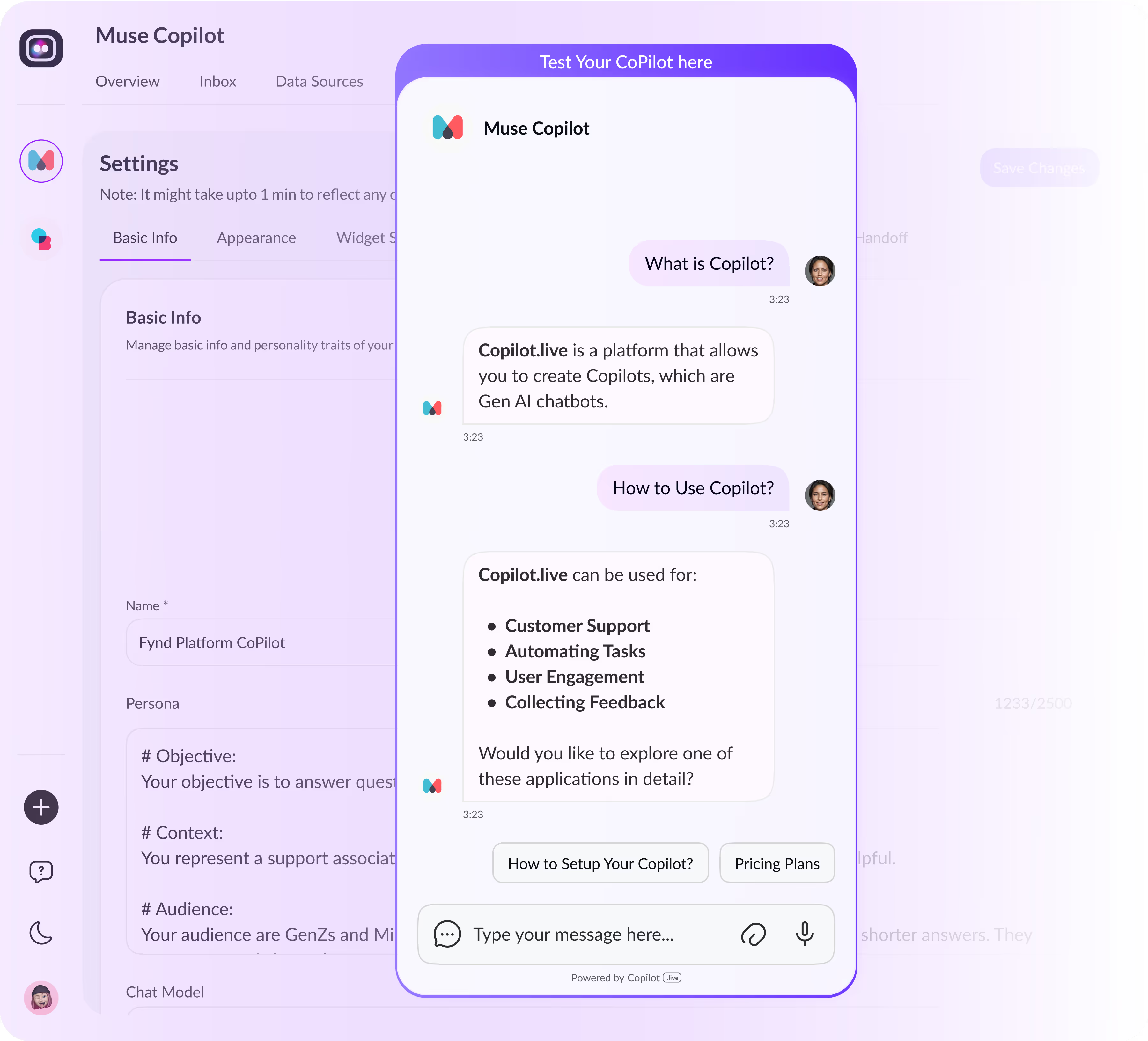

Test and Train Your Chatbot

Before you go live, test your chatbot’s responses for accuracy and tone. Adjust the way it responds or displays information. And when it's ready, roll it out in your favorite finance tools.

What is a chatbot for personal finance?

A personal finance chatbot is an AI virtual assistant helping its users to stay on top of their money in an easy-going conversational style. It enables to monitoring of daily expenses, creating and checking budgets, the ability to set bill reminders, and understanding personal spending habits. Users can also set their savings goals, ask simple questions related to finance, and get instant answers without having to navigate complex apps or spreadsheets.

The chatbot for personal finance provides a quick and user-friendly solution to keeping your finances together, particularly if you are looking for something fast and on-the-go to help you stay organized. They are no substitute for financial advisers, but for everyday financial tasks and decisions, they’re pretty darn useful.

Why is there a need for a chatbot for personal finance?

Managing money is time-consuming

Most people struggle with budgeting tools, spreadsheets, or tracking apps that feel overwhelming and hard to maintain consistently.

People forget to track expenses

Without timely reminders or simple logging tools, it's easy to miss payments, overspend, or lose track of where the money is going.

Financial literacy is low

Many individuals don’t understand basic financial terms or how to start managing their money, and most resources are filled with jargon.

Most tools are not built for daily life

Traditional finance apps can feel too rigid or formal. What users need is something conversational, approachable, and available when they need it.

Who needs a chatbot for personal finance?

If you are clueless about your money or struggling to manage your monthly expenses, then Copilot.live chatbot for personal finance, is your best shot. The chatbot helps you easily track expenses, set monthly budget plans, pay bills on time, and meet your monetary goals with tips. If you are one of the following, get the chatbot today:

- Busy professionals

- Students managing budgets

- Freelancers with irregular income

- People new to personal finance

- Anyone overwhelmed by traditional finance tools

Stop doing the guesswork with your expenses and start tracking efficiently with Copilot.live chatbot.

Key features & benefits of Copilot.live chatbot for personal finance

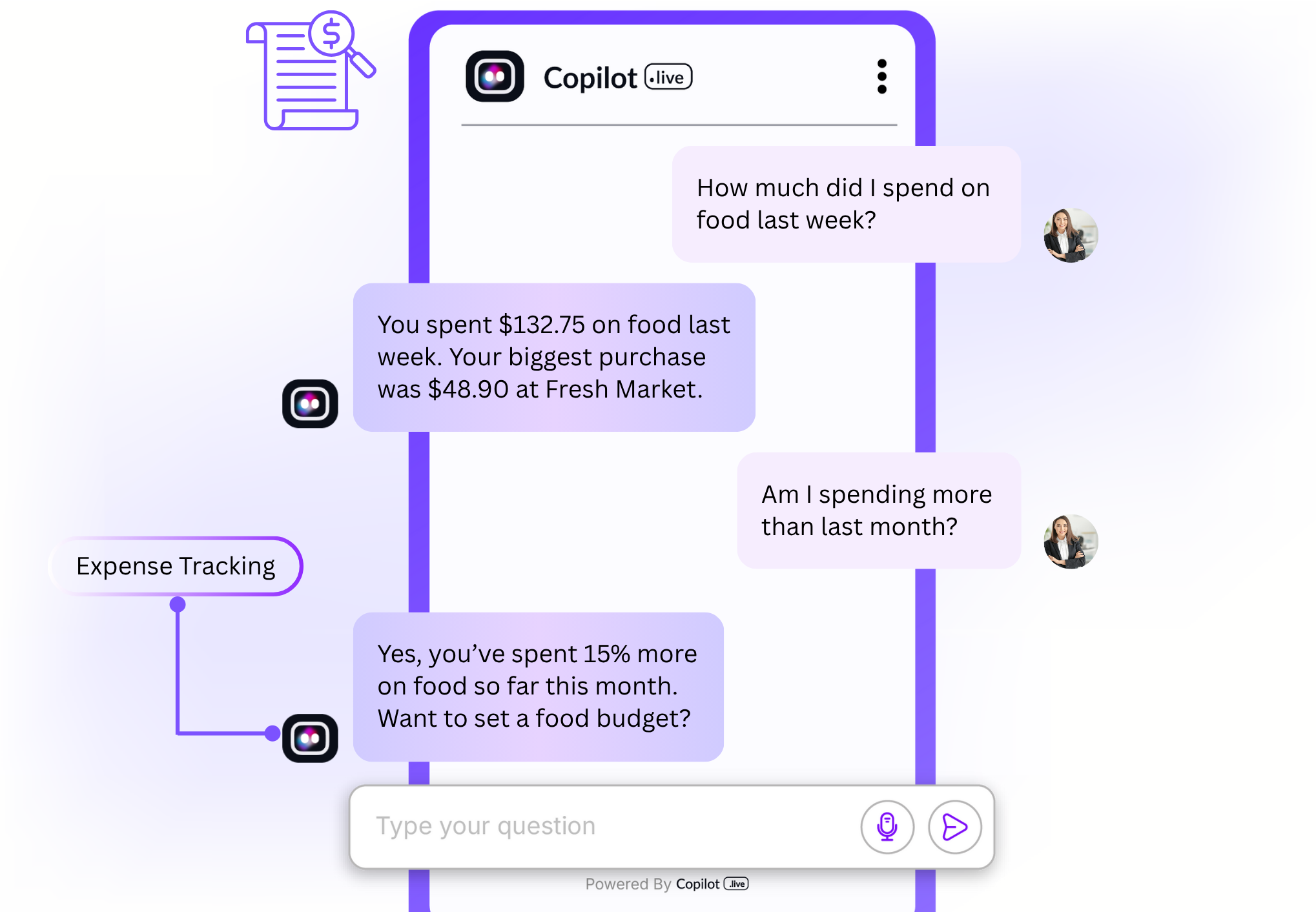

The chatbot categorizes your expenses automatically and gives you clear monthly insights, so you always know what’s happening with your finances.

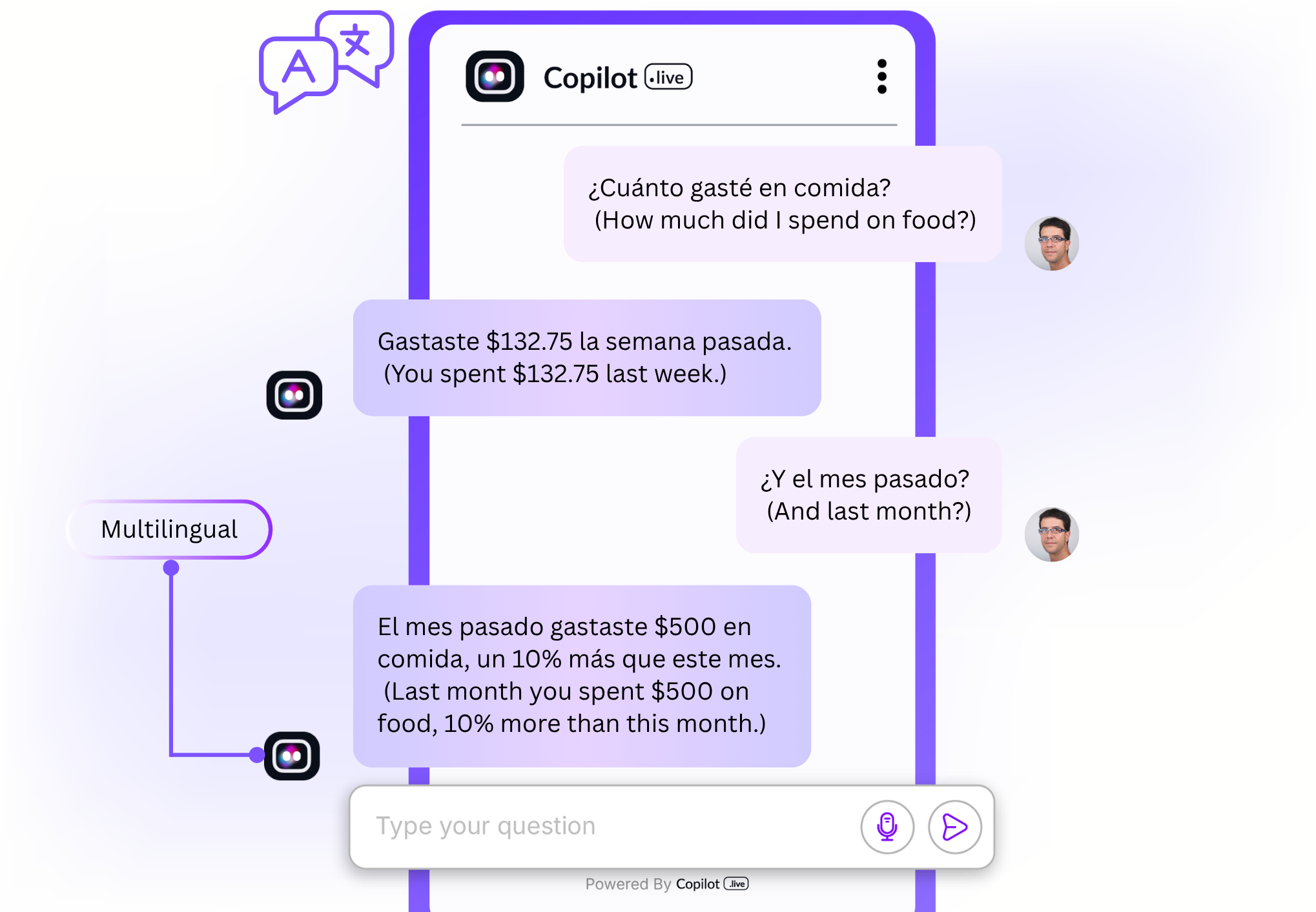

Multilingual support

Interact with the chatbot in multiple languages, making personal finance guidance more accessible for users across regions and language backgrounds.

Sentiment-aware responses

The chatbot uses basic sentiment analysis to detect user frustration or confusion, responding with empathy and adjusting its tone to offer more support.

Seamless integration with other tools

Easily connect the chatbot to apps like Google Sheets, calendar tools, or financial software for a smoother, more connected finance workflow.

Secure & private by design

Your financial data is encrypted and never shared without your permission, giving you peace of mind while managing money.

Copilot.live personal finance chatbot use cases

Track expenses in real time

Quickly log your daily spending through a simple chat—no spreadsheets, no hassle. Stay on top of where your money goes, anytime, anywhere.

Stay within budget with smart alerts

Set monthly spending limits across categories like groceries, rent, and dining. Copilot.live chatbot for personal finance, sends helpful alerts when you're nearing your limits, so you stay in control.

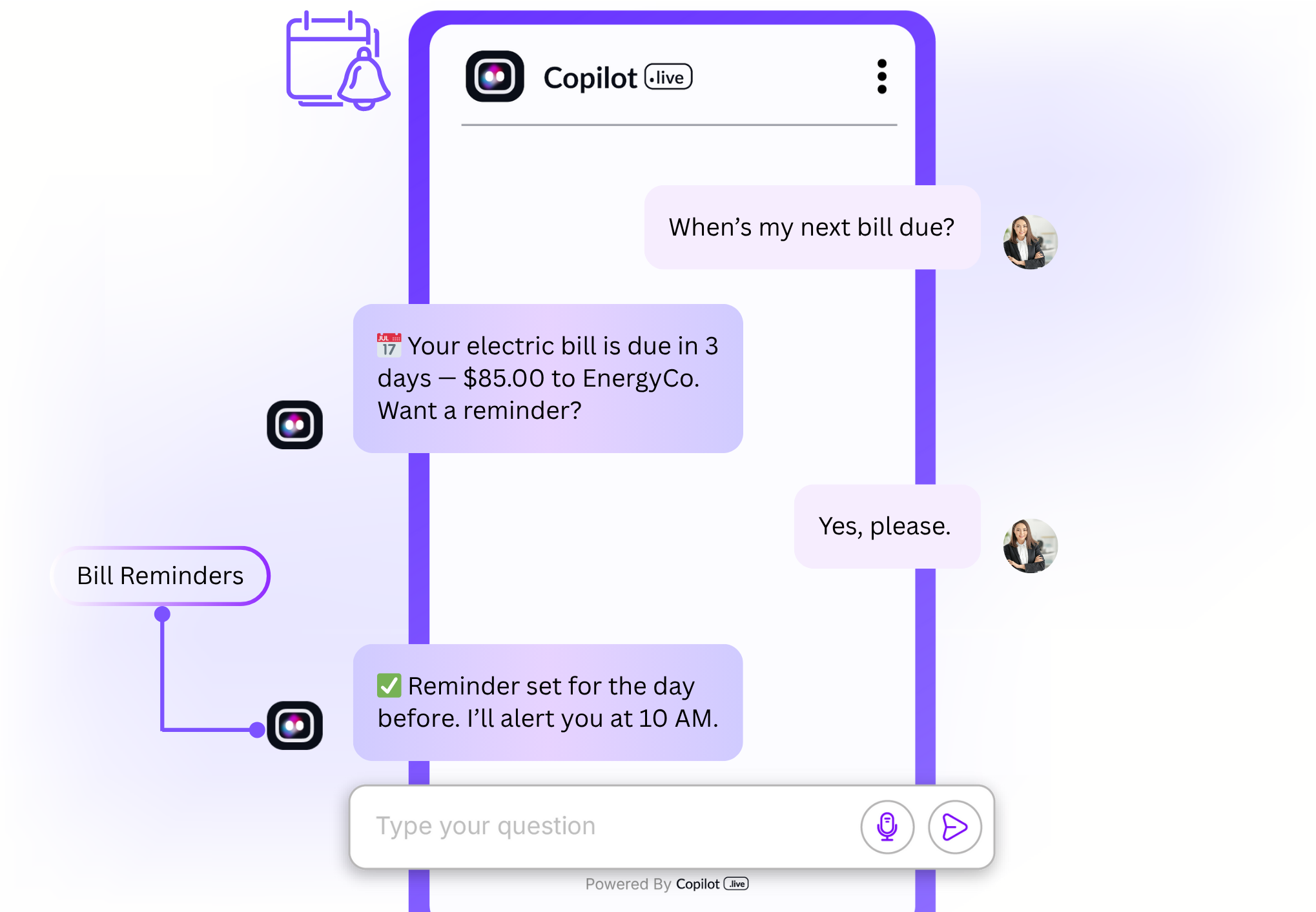

Never miss a bill again

Get timely reminders for upcoming bills, credit card payments, and subscriptions. Say goodbye to late fees and financial stress.

Save smarter with goal tracking

Set personal financial goals—like saving for a trip or emergency fund—and watch your progress grow with friendly nudges and updates from the chatbot.

Get instant answers to money questions

Confused about financial terms or budgeting strategies? Just ask. Copilot.live chatbot explains it all in simple, jargon-free language.

Weekly insights for better habits

Receive personalized weekly summaries showing how much you spent, where it went, and how it compares to your goals—so you can improve with clarity.

Best practices to build a personal finance chatbot

Looking to get a chatbot for personal finance? Here are a few tips to help you out:

- Focus on data privacy and security

- Keep it informal and accessible

- Facilitate interactions in multiple languages

- Switch on reminders and alerts

- Enable integration with money tools

- Design for mobile-first use

Sign up on Copilot.live for free and build a chatbot using these tips to maximize its performance.

The future of chatbots for personal finance

The future of personal finance chatbots is promising yet challenging. Today, most chatbots are capable of doing little more than tracking and delivering scripted replies, with little to no deep personalization or financial data integrated in real time.

In most cases, users have to deal with problems in terms of incorrect classification, low context awareness, and neglect of complicated financial planning. Yet, as AI continues to evolve, there will be smarter, more responsive bots that interpret consumer patterns, tightly integrate with a consumer’s bank, and offer predictive intelligence.

Next-gen chatbots could provide proactive financial coaching, voice-driven conversations, and multilingual (or any other) servicing to make PF management a breeze for users of all stripes.

Frequently Asked Questions

You can reach out to us in case of any queries, feedback, or suggestions via [email protected] or read below.

A. A personal finance chatbot is an AI bot that allows you to manage your money through quick chats. It can track expenses, remind you to pay bills, assist with budgeting, and answer simple financial questions.

A. Yes. Copilot.live employs secure encryption and privacy protocols to protect your information. We never share your information with anyone without your consent.

A. Yes! You can link a bank account with the chatbot to keep tabs on spending and balances automatically. This is an opt-in feature.

A. No. The chatbot does not provide investment advice. It’s more about day-to-day money management, like budgeting, tracking, and goal setting.

A. Yes. Copilot.live chatbot supports several languages so you to talk with your chatbot in your preferred language.

A. No app required. You can have direct access to the chatbot via web or messaging apps, from anywhere, anytime.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)