Get Your Copilot

Create an AI Chatbot for Financial Advisors

Empower your financial practice with a chatbot that answers client queries, schedules consultations, and collects KYC data, so you can focus on delivering tailored financial advice.

Create an AI Chatbot for Financial Advisors

Empower your financial practice with a chatbot that answers client queries, schedules consultations, and collects KYC data, so you can focus on delivering tailored financial advice.

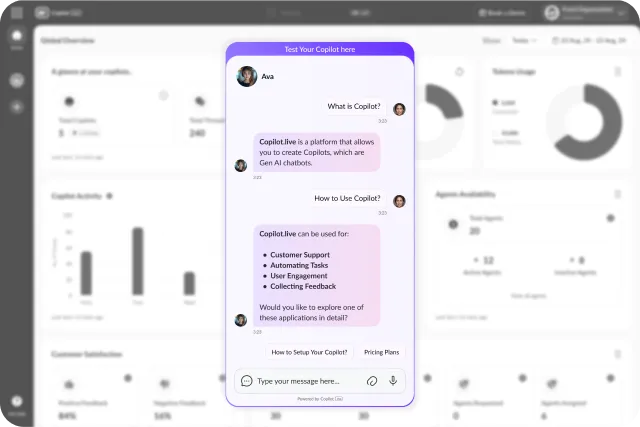

Build an AI assistant in 3 minutes

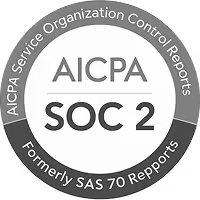

How to build a chatbot for financial advisors?

Sign up for free

Open Copilot.live website and look for the “Sign up” button. Next, enter your name and email ID, and then set a password to create your profile. Or, you can skip all these and create your profile in a single click using your Google ID.

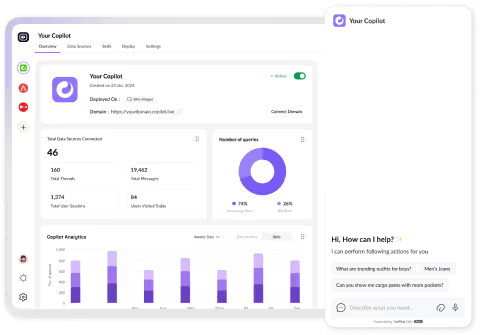

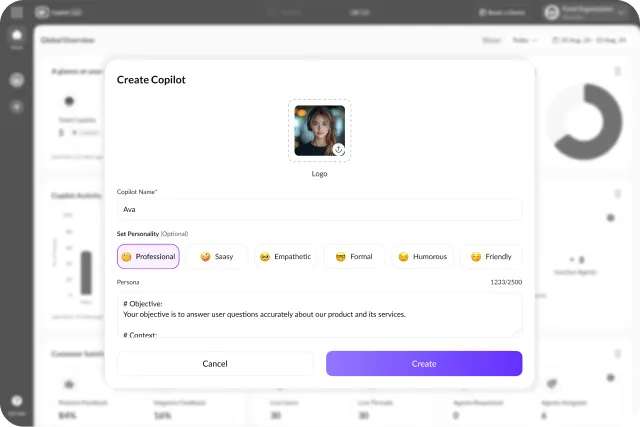

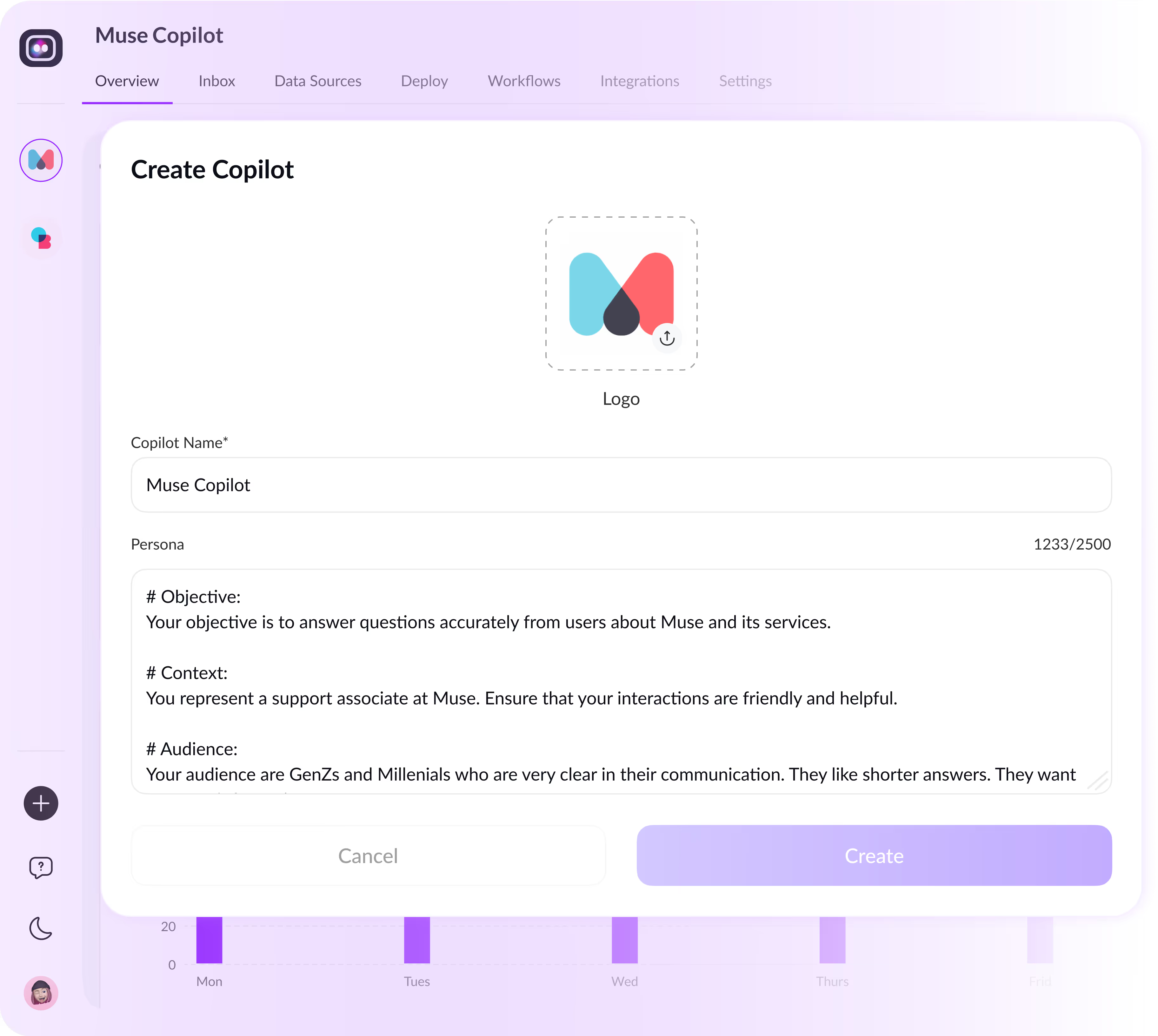

Customize the chatbot

Once your profile is up, you can set up the look of your chatbot. You can customize its name, colour, tone, style, and answer format. All these ensure that your chatbot is aligned with your brand guidelines.

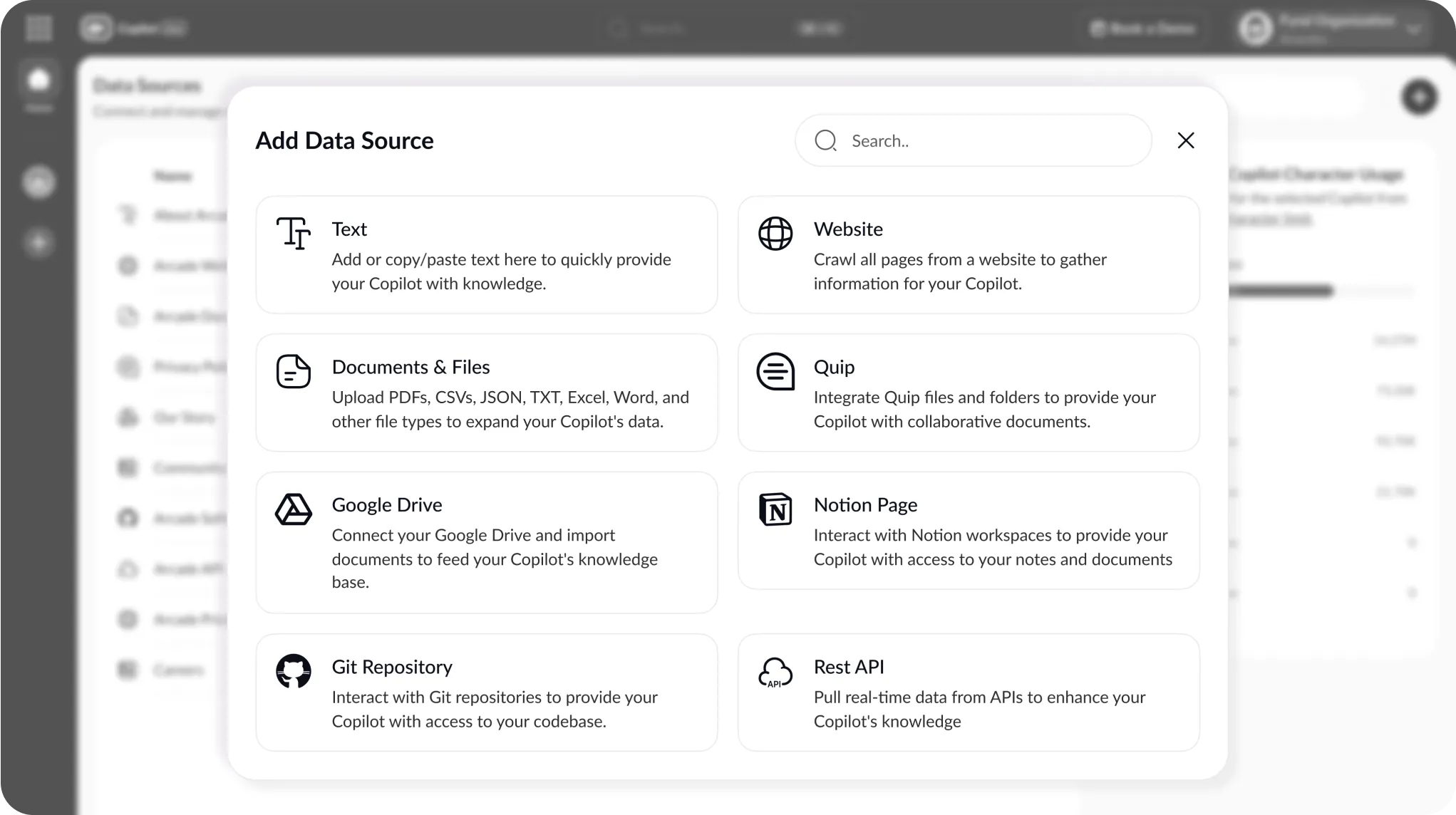

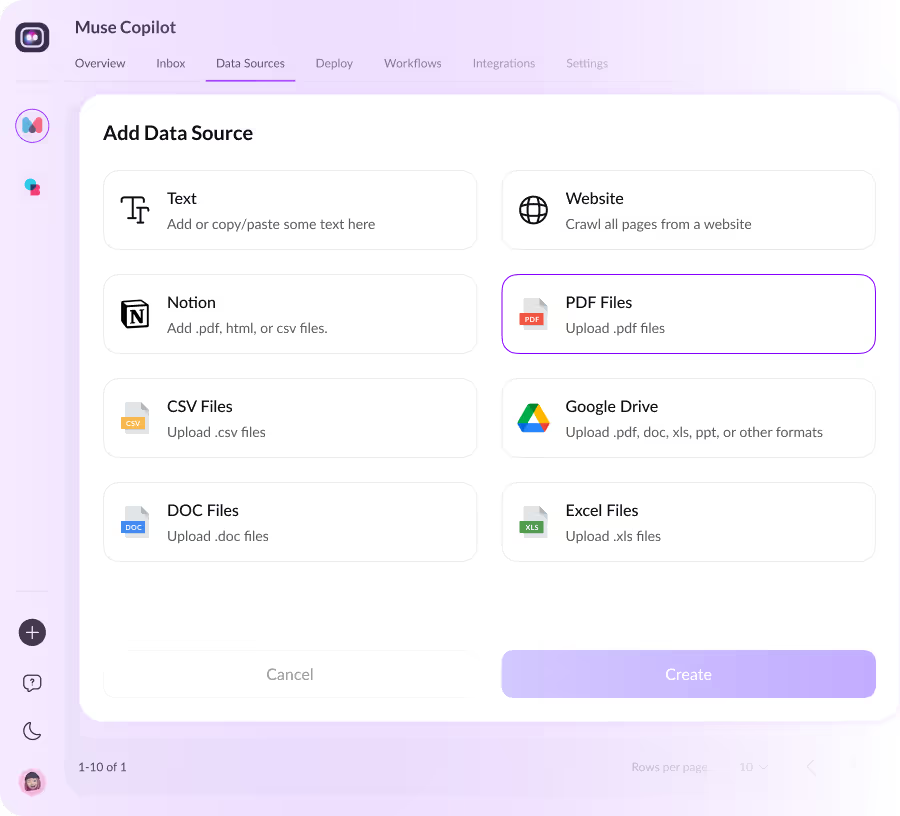

Add data sources

The next step is to add data sources and train the chatbot. The best way to do this is to add multiple data sources that are structured, up-to-date, and relevant to your business and target audience.

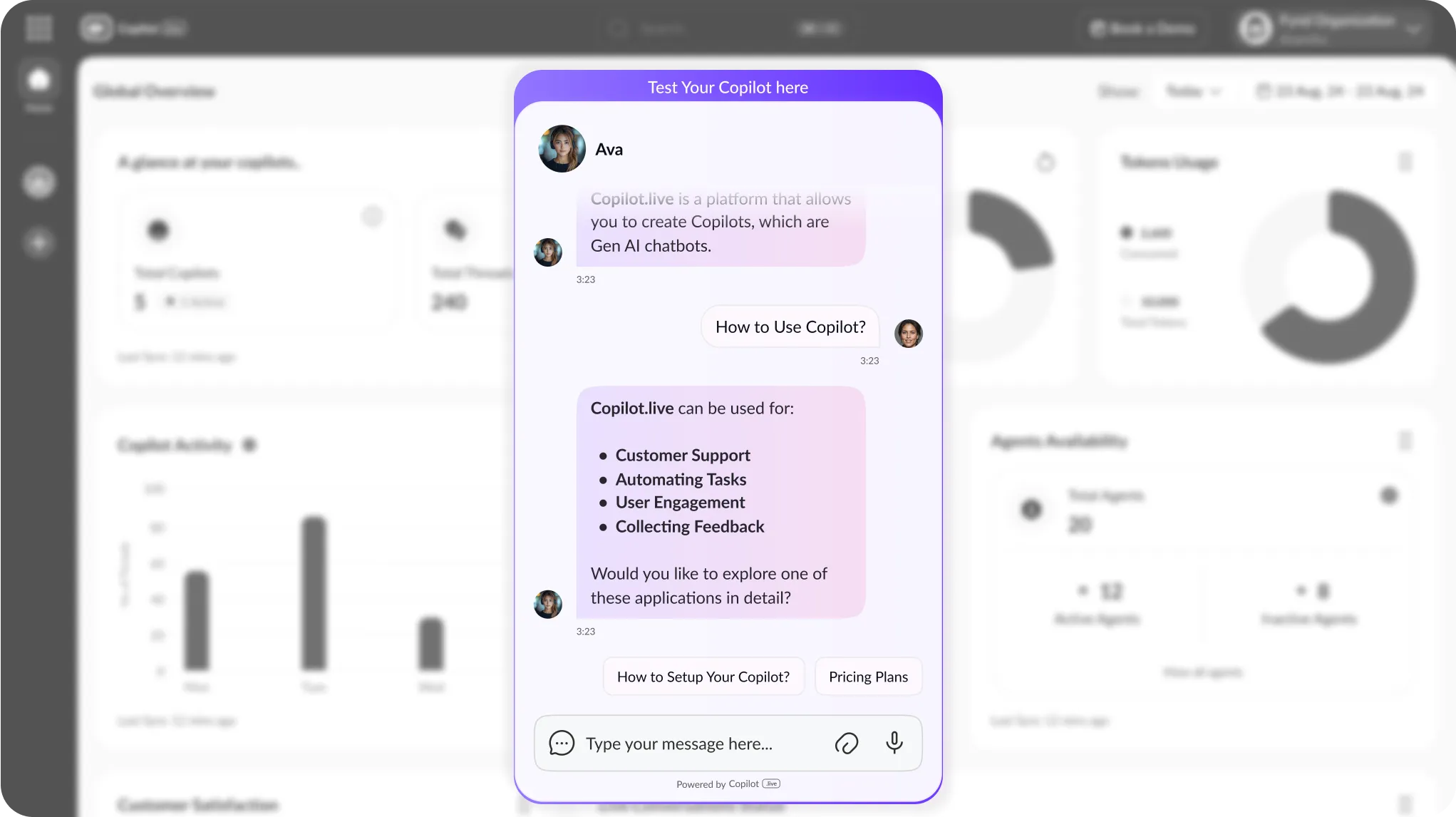

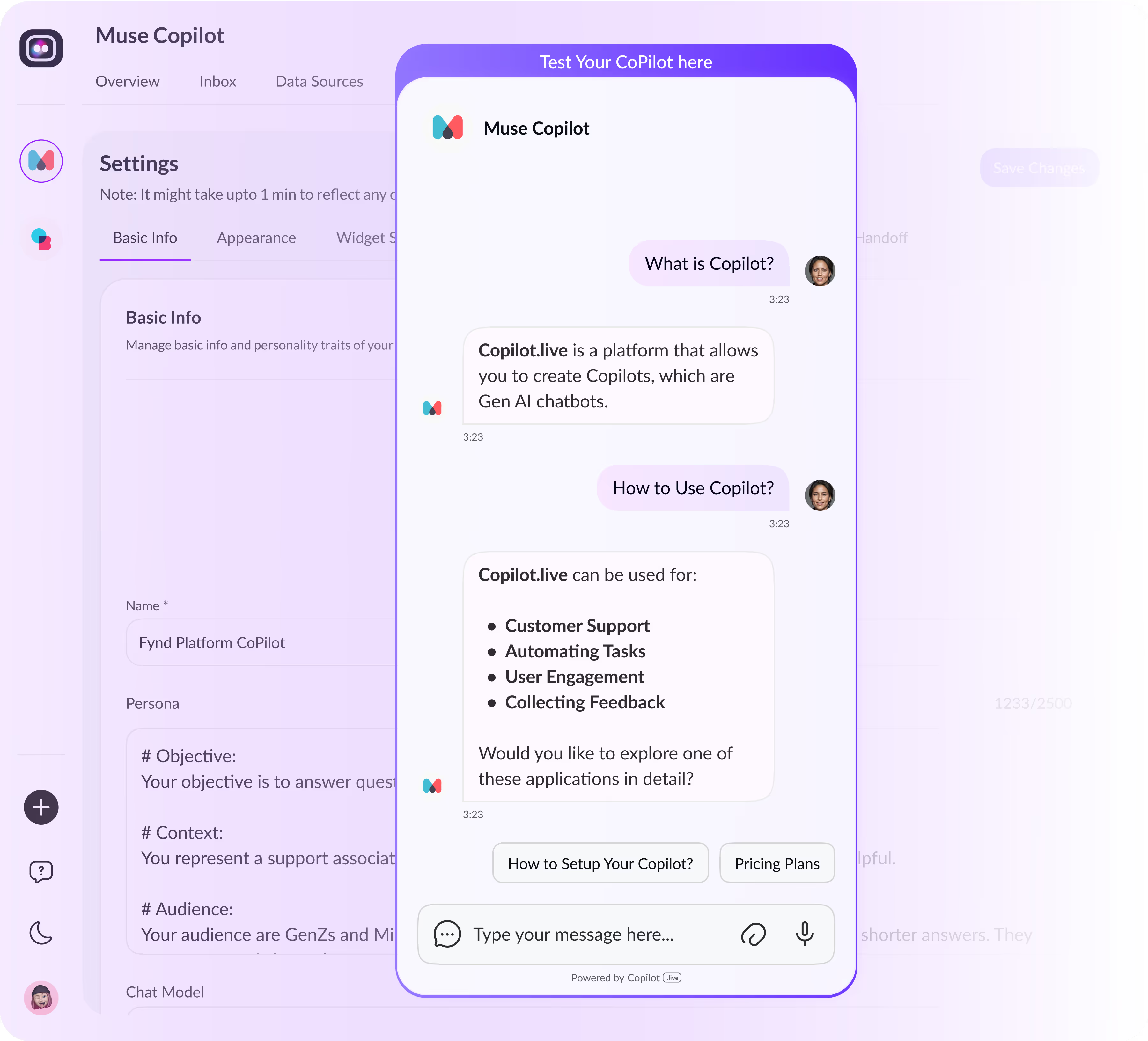

Test & deploy

Finally, we need to track the chatbot's progress and optimise the results. You can instruct the chatbot to alter its style, tone, and manner of responding. Even after you are happy with its performance, you can easily roll it out to your corporate tools, websites, apps, and systems.

What is a chatbot for financial advisors?

A financial advisor chatbot is an AI chatbot designed to streamline and augment communication with clients. It directly connects with prospects and clients in organic, live conversations, answering questions, qualifying leads, scheduling a time to meet, and safely securing financial information.

The virtual chatbot can manage routine work, making immediate responses and showing users the right way to investment planning, insurance, and retirement options services. Built for compliance and privacy, it plugs into CRMs and calendars, so companies will run more efficiently, while giving clients a seamless and premium digital experience.

Why is there a need for a chatbot for financial advisors?

Clients expect 24/7 access to information

In today’s digital-first world, clients want instant responses, even outside business hours, something traditional financial practices struggle to offer consistently.

Overwhelmed with repetitive queries

Financial advisors spend significant time answering the same basic questions, reducing their availability for deeper, value-driven conversations.

High lead drop-off rates

Potential clients often lose interest or move on if they don’t receive timely guidance during their initial visit to a website or inquiry.

Manual onboarding is time-consuming

Gathering client information, assessing their needs, and qualifying leads through manual processes slows down conversion and eats into advisor productivity.

Who needs a chatbot for financial advisors?

Wasting time manually answering client queries, screening leads, analyzing data, and onboarding clients?

Upgrade your business with a custom chatbot built to align with your workflows and style. If you are any one of the following, then Copilot.live chatbot for financial advisors, will benefit you immensely:

- Independent financial advisors

- Wealth management firms

- Tax consultants

- Insurance advisors

- Retirement planners

- Robo-advisory platforms

With Copilot.live chatbot, you will have faster onboarding, quality lead fulfillment, and better client meetings. Build your chatbot today!

Key features & benefits of Copilot.live chatbot for financial advisors

Let clients book appointments, ask questions, and explore financial plans, even when you're offline.

Secure data collection with encryption

Collect sensitive financial information using end-to-end encryption and data masking to ensure client confidentiality and compliance.

Smart appointment scheduling integration

Seamlessly integrates with tools like Calendly, Google Calendar, or your CRM to allow real-time booking of consultations.

Omnichannel presence

Deploy the chatbot across the website, WhatsApp, Facebook Messenger, and email, ensuring a unified client experience.

Compliance-friendly logging & audit trails

Every conversation is time-stamped, logged, and stored securely to help with regulatory reviews and internal compliance.

Copilot.live Chatbot for Financial Advisors Use Cases

Wealth Management Firms

Automate client profiling, investment strategy exploration, and portfolio FAQs to streamline wealth advisory operations.

Insurance Advisors

Assist users in understanding policies, comparing coverage, and submitting claim-related queries in real time.

Tax Consultants & Planners

Guide clients through tax-saving instruments, filing timelines, and document requirements while collecting basic financial data.

Retirement Planning Services

Help users calculate retirement goals, understand plan options, and clarify withdrawal or contribution rules interactively.

Robo-Advisory Platforms

Provide onboarding assistance, risk assessment, and investment education to improve digital engagement and reduce churn.

Financial Education Platforms

Answer user questions about investing, budgeting, and market trends with AI-curated, easy-to-understand responses.

Tips to build a reliable chatbot for financial advisors

Building a chatbot for financial advisors is hassle-free on Copilot.live platform. However, there are a few key factors that you should focus on to build a reliable and secure financial chatbot. They are:

- Use secure data handling

- Personalize conversation flows

- CRM & calendar integration

- Train on financial FAQs

- Ensure compliance with regulations

- Keep the chatbot professional but not too stiff or formal

- Offer a human handover option

- Monitor and refine regularly

Sign up for free today and explore how this chatbot can boost your business efficiency within weeks.

What's next for financial advisors' chatbots?

Financial advisors chatbots are evolving toward deeper personalization, advanced automation, and seamless integration. It is safe to say that ongoing progress in machine learning will enable these AI chatbots to generate finely tailored financial recommendations. It will be possible by analyzing individual usage patterns, risk tolerances, and dynamic market indicators.

By interfacing directly with customer relationship management platforms, portfolio management software, and compliance dashboards, chatbots will reduce administrative load, ensuring secure and instantaneous data synchronization across the advisory process.

The addition of natural language voice interaction and multilingual capabilities will broaden user reach. Responsive to changing regulatory frameworks, these systems will embed compliance-verification processes that update in real time. The net effect will be a transition from supplementary helpdesk agents to intelligent co-advisors, sharpening client confidence and improving advisors’ operational effectiveness in a continually shifting financial environment.

Frequently Asked Questions

You can reach out to us in case of any queries, feedback, or suggestions via [email protected] or read below.

A. Copilot.live chatbot automates lead capture, client onboarding, FAQs, and appointment scheduling, freeing up your time for high-value consultations.

A. Yes. Copilot.live chatbot uses end-to-end encryption and follows strict data compliance protocols to ensure all client information is handled securely.

A. Absolutely. The chatbot integrates seamlessly with tools like Salesforce, Wealthbox, Redtail, Calendly, and Google Calendar for streamlined operations.

A. Not at all. Copilot.live chatbot uses natural language processing (NLP) to create human-like, personalized conversations that align with your brand tone.

A. Yes. You can create branching conversation flows that deliver relevant responses based on each client’s profile and financial goals.

A. No coding required. Copilot.live offers an easy-to-use interface with pre-built templates tailored for financial advisors.

.avif)

.avif)

.avif)

.avif)

.avif)

.avif)